One of the biggest misconceptions business owners have is thinking that personal credit determines whether they can get approved for a merchant cash advance (MCA) or unsecured working capital financing.

But here's the truth:

Your personal credit score is NOT the main factor. In most cases, it has little to no impact at all.

Why?

Because MCAs and revenue-based working capital programs are designed to look at the business, not the individual. These programs exist specifically for business owners who:

- Have strong revenue but less-than-perfect credit

- Are growing fast and need capital quickly

- Don't have collateral or time for a traditional bank loan

- Have past credit issues but stable daily cash flow

Here's a simple, real-world explanation you can give to future merchants:

MCA Lenders Don't Care About Your Personal Credit — They Care About This Instead:

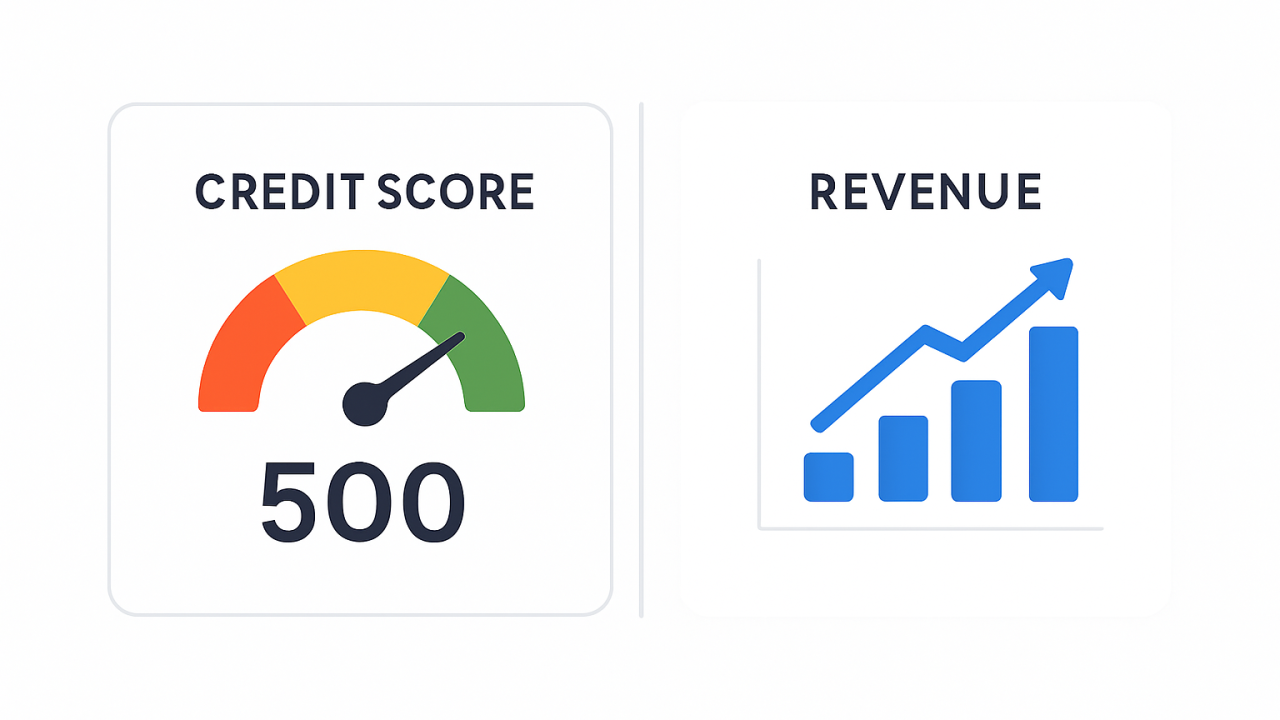

1. Your Revenue

If your business consistently brings in deposits (daily, weekly, or monthly), lenders see that as a reliable repayment source.

They're buying a portion of future receivables, not relying on your personal credit history.

2. Your Cash Flow

Lenders look at:

- Average daily balances

- How often your account goes negative

- Deposit frequency

- Stability of sales

This tells them more about your business's strength than a FICO score ever could.

3. Your Industry & Time in Business

A business that's been operating for 6–12+ months with stable sales is far more important to an MCA lender than the owner's personal credit.

4. Your Existing Obligations

Instead of checking credit card utilization or personal debt, MCA lenders look at:

- How many advances you already have

- Whether you're stacking

- Your ability to sustain another funding

So Here's the Bottom Line:

A merchant cash advance is not based on personal creditworthiness.

It's based on business performance.

That means:

- You can get approved with a 500 credit score

- You can get funding even if personal credit cards are maxed

- You can get capital if you've had past defaults or late payments

- You can still get approved even after personal financial setbacks (divorce, medical bills, etc.)

This type of financing exists to support real business owners who don't fit the bank's perfect credit box.

Why This Matters for Business Owners

Most entrepreneurs run their businesses with a simple priority:

"Keep cash flowing, keep customers happy, keep the business alive."

Your personal credit score doesn't always reflect how strong and capable your business really is.

Revenue-based financing understands that.

It looks at:

- What your business is doing today

- What your business can generate tomorrow

- How your deposits tell the real story

Not what happened to your personal credit years ago.

At Spring Advance

We work with programs that approve merchants based on performance, not personal perfection.

If your business is producing — we can help you get funded.