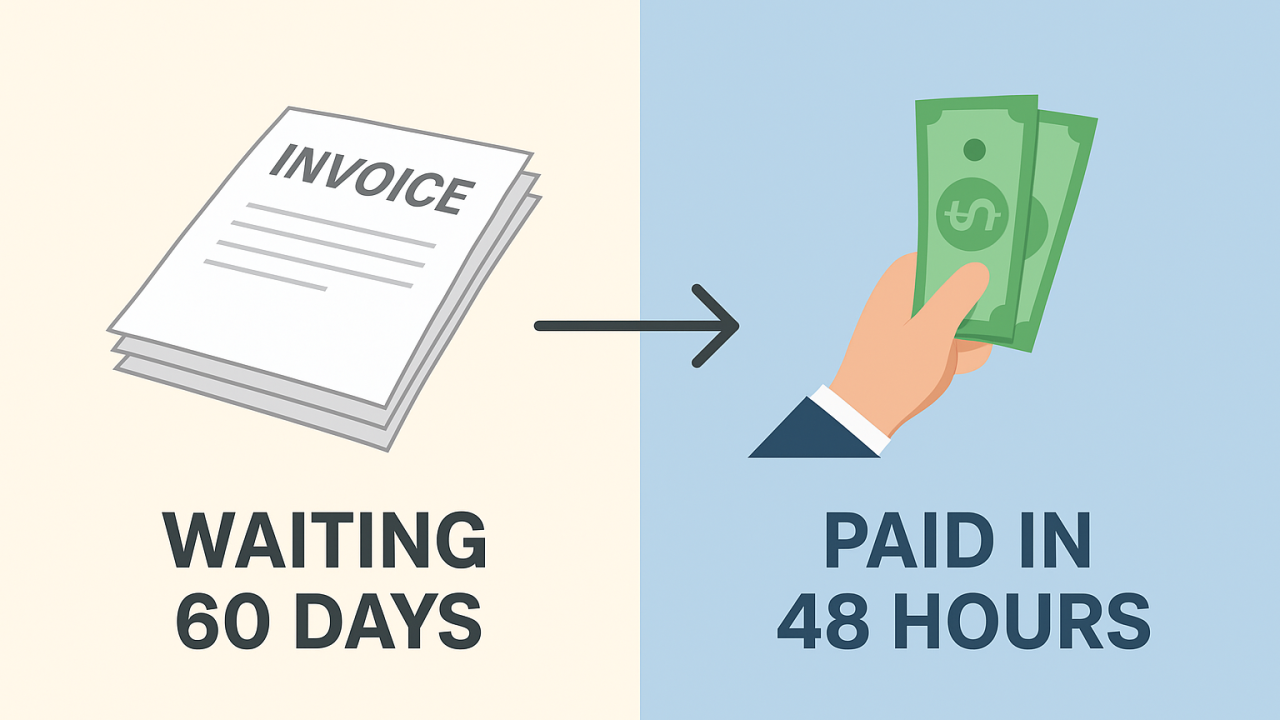

When you're running a business, cash flow is everything. Yet many companies find themselves waiting 30, 60, or even 90 days for customers to pay their invoices. That delay can create real strain when you need to cover payroll, buy inventory, or invest in growth.

That's where factoring comes in.

Factoring is a financing solution that converts your unpaid invoices into immediate working capital without taking on traditional debt. Instead of waiting weeks or months for payments, your business can get access to cash in as little as 24–48 hours.

How Factoring Works

Factoring is straightforward:

- You issue an invoice to your customer (standard payment terms: 30–90 days).

- A factoring company (the "factor") purchases the invoice at a small discount.

- You receive an advance of 70–90% of the invoice value right away.

- The factor handles collection from your customer.

- Once payment is made, the remaining balance is sent to you—minus fees.

Why Businesses Use Factoring

✅ Improved cash flow – Get paid faster and put that money to work.

✅ Flexibility – Financing grows as your sales grow.

✅ Stress-free collections – The factor manages receivables.

✅ No new debt – You're leveraging money already owed to you.

Industries like manufacturing, trucking, staffing agencies, construction, and healthcare often rely on factoring to keep operations moving smoothly.

Is Factoring Right for You?

Factoring can be a smart solution if your business:

- Has strong sales but slow-paying customers

- Needs working capital for payroll, inventory, or growth initiatives

- Wants to unlock cash flow without taking on loans or giving up equity

At Spring Advance, we specialize in helping businesses understand all their funding options. The right financing tool can make the difference between staying stuck and scaling with confidence.

Want to learn more about how factoring can improve your company's cash flow? Connect with us at Spring Advance, we'll walk you through your options and help you secure the capital you need to grow.